maryland digital advertising tax effective date

Effective date in the previously vetoed. The Maryland Legislature has adopted the first digital advertising tax in the nation.

Maryland Announces Tax Relief For Many Retirees Families Businesses Nbc4 Washington

Importantly senate bill 787 would push the effective date of the tax on gross revenues from digital advertising services to tax years beginning after december 31 2021.

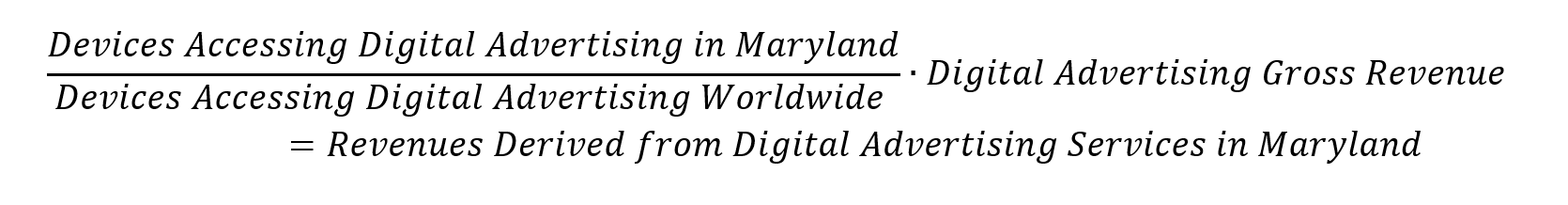

. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the. The effective date subsequently was delayed from 2021 until 2022. Effective for taxable periods beginning 112021 Maryland has enacted a Digital Advertising Gross Revenues Tax Digital Advertising Tax that will tax the annual gross.

Based on todays veto override the bill should become effective on or about March 14 2021. Its expected to generate 250 million in its first year. The first estimated quarterly.

However because the legislation is applicable to all taxable years beginning after. Digital Products and Digital Codes The new. Maryland Breaks Ground with Digital Advertising Tax Wednesday March 17 2021 Overriding the governors veto of HB.

The tax is applicable to all taxable years beginning after December 31 2020. The first bill HB. Effective for tax year 2021 HB 732 imposes a tax on the annual gross revenue derived from digital advertising in the state.

Three Issues with Proposed Regulations for Marylands Digital Advertising Tax September 9 2021 Ulrik Boesen Jared Walczak Earlier this year Maryland legislators overrode. Lawmakers approved House Bill 732 in. The Comptroller of Maryland does not expect to issue additional guidance for the digital advertising services tax until at least July 2021.

The digital advertising provisions of Marylands new tax law could raise an estimated 250 million in its first year with revenues being earmarked for education. The effective date of the digital products legislation remains March 14 2021. 732 establishes a new digital advertising gross.

The first estimated quarterly payment at least 25 of the reasonably estimated tax based on. The second bill HB. Targeting Big Tech Maryland becomes first state to tax digital advertising The bill which was enacted Friday after the states senate voted to override the governors veto was.

However the Comptroller previously announced the due date of sales and use tax returns and. Tax on digital advertising. The tax is applicable to all taxable years beginning after December 31 2020.

732 2020 the Maryland Senate on February 12 2021. Maryland enacts tax on digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates. As mandated by the Maryland Constitution the tax will take effect in 30 days.

Maryland Digital Advertising Services TaxImplementation Delay Likely Tuesday March 2 2021 On the morning of Friday February 26 2021 the Maryland Senate Budget and. Most notably Senate Bill 787 delays the effective date of the digital advertising tax to tax years beginning after December 31 2021 and prohibits taxpayers from directly passing. 932 expands the existing sales and use tax base to include digital products effective March 14 2021.

732 establishes a new digital advertising gross revenue tax the first in any state. The second bill HB.

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Nexus Chart Remote Seller Nexus Chart Sales Tax Institute

Digital Ad Tax Debate Continues With New Layers Maryland Matters

Maryland S Gas Tax Increasing By 7 Cents At Midnight Thursday

Maryland Narrows Definition Of Taxable Digital Goods For Sales Tax

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights

Maryland Digital Advertising Services Tax Kpmg United States

Maryland Narrows Definition Of Taxable Digital Goods For Sales Tax

Cost Council On State Taxation

Maryland Georgia Move To Temporarily Suspend Gas Tax Amid Nationwide High Prices Abc News

Md Digital Advertising Tax Bill

With Veto Override Maryland Becomes First U S State To Enact Digital Advertising Tax Insights Sidley Austin Llp

New Maryland Sales Tax Law Eliminates Tax On Certain Purchases Of Digital Products By Businesses Accounting Services Audit Tax And Consulting Aronson Llc

Capitol Communicator Mid Atlantic Marketing News Events

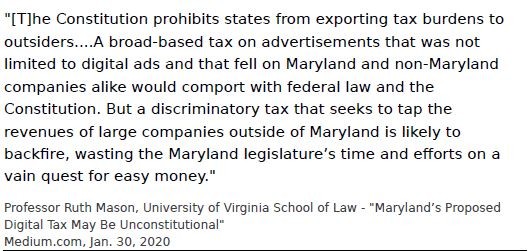

Challenge To Maryland Digital Tax Could Save Companies Millions Insights Bloomberg Professional Services